A member of the Gemini Team would be happy to guide you through the application process.

GET IN TOUCH TODAY!

GEMINI TOWNHOMES

40 NEW CONTRUCTION CONDOMINIUMS

All 40 new constructed condominiums are available FOR SALE only to qualified first-time buyers. This affordable housing community offers 2- and 3-bedroom units, each with modern finishes, an attached one-car garage, and up to 1.5 baths. Units range up to 1,509 in square feet. To purchase, you must be a qualified first-time homebuyer, with an income up to 80% or 100% of the Area Median Income (AMI). Household assets must not exceed $100,000 in total (additional restrictions may apply). You must complete an application and provide a mortgage pre-approval letter and all required documentation to be considered. All are encouraged to apply!

FEATURES

2 & 3 BEDROOM UNITS

2 & 3 BEDROOM UNITS

AFFORDABLE PRICING

AFFORDABLE PRICING

ENERGY EFFICIENT

ENERGY EFFICIENT

LUXURY FINISHES

LUXURY FINISHES

PRIVATE ATTACHED GARAGES

PRIVATE ATTACHED GARAGE

PRIVATE USE PAVILLION

PRIVATE USE PAVILLION

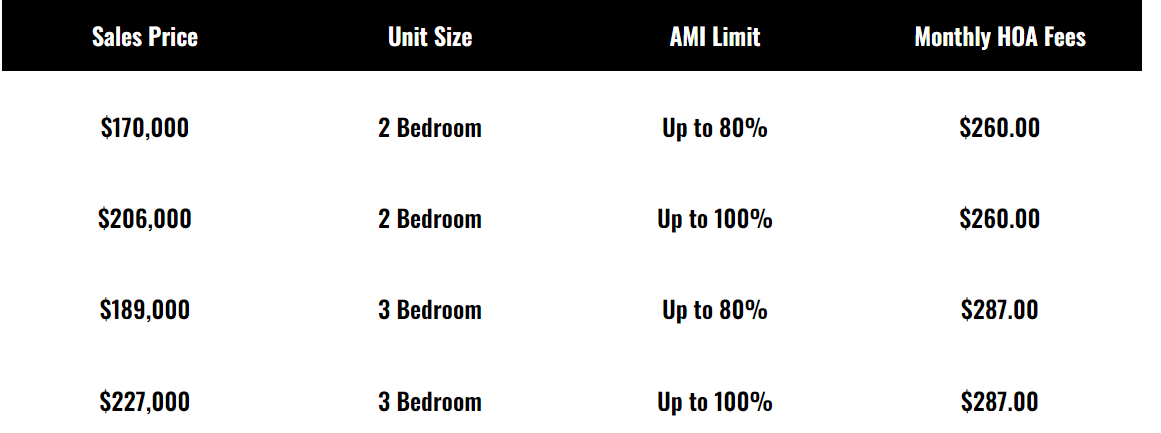

CONDOMINIUM PRICING

Price per unit will range from $170,000 to $206,000 for a 2-bedroom and $189,000 to $227,000 for a 3-bedroom depending on your household size and family's total household income. You must not exceed the total AMI limit for your household size and unit size selected in order to be eligible. AMI limits are shown below. The Homeowners Association (HOA) fee is an additional monthly fee you pay for the update and maintenance of your community and use of communal property like the covered pavilion. The fee will depend on the bedroom size of your unit as shown below.

*The Area Median Income (AMI) limit is determined by the US Department of Housing and Urban Development (HUD) and subject to change annually. These limits are based on the 2024 limits.

*Your total Assets cannot exceed $100,000 to qualify. Qualified retirement accounts are not counted towards the asset limits.

Sales Price

Unit Size

AMI Limit

Monthly HOA Fees

$170,000

2 Bedroom

Up to 80%

$260.00

$206,000

2 Bedroom

Up to 100%

$260.00

$189,000

3 Bedroom

Up to 80%

$287.00

$227,000

3 Bedroom

Up to 100%

$287.00

QUALIFY TO PURCHASE

MUST BE A QUALIFIED FIRST-TIME HOMEBUYER

FIRST-TIME HOMEBUYER

SECURE A MORTGAGE LOAN

GET FUNDING

MUST SUBMIT AN APPLICATION AND BE ACCEPTED

LOTTERY APPLICATION

MUST MEET CERTAIN INCOME AND ASSET GUIDELINES

INCOME AND ASSETS

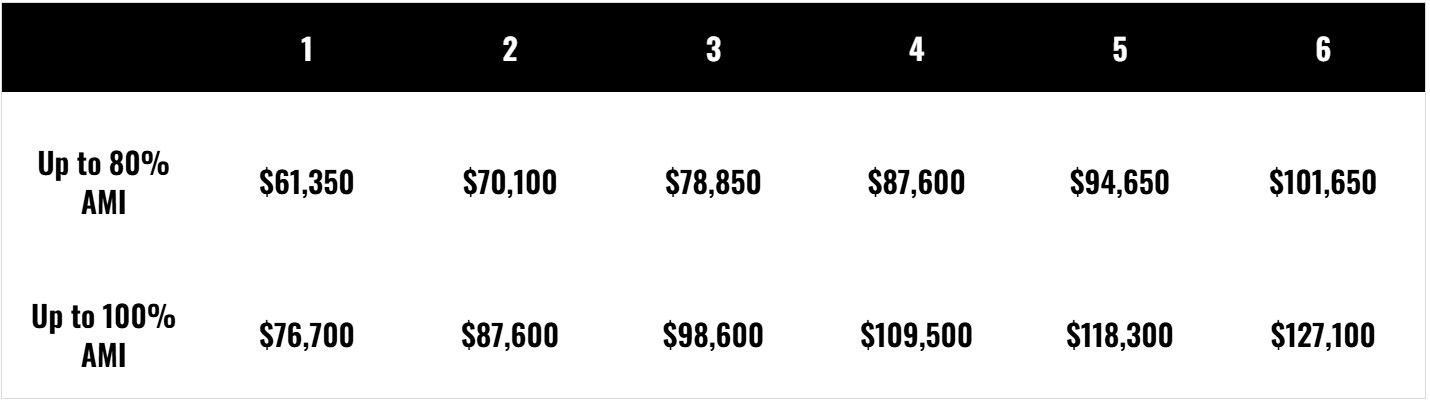

MAX ALLOWABLE HOUSEHOLD INCOME

The income chart below is used to determine the maximum allowed income used to determine eligibility for these condominiums. Household size is the total number of people that will live in your unit upon closing. Household income is determined by calculating the number of household members that are 18 years of age and older that generate any form of income.

*FHA and VA loans not eligible at this time.

*AMI limits vary and may be updated as they are released by HUD. These limits are based on the 2024 limits.

INCOME LIMITS BASED ON HOUSEHOLD SIZE

1

2

3

4

5

6

Up to 80% AMI

$61,350

$70,100

$78,850

$87,600

$94,650

$101,650

Up to 100% AMI

$76,700

$87,600

$98,600

$109,500

$118,300

$127,100

APPLY NOW

Those interested in purchasing a Gemini Townhome are encouraged to apply. Units will be offered in order that the applications are received.

Download your application by clicking "Apply Now" below. You MUST submit a mortgage pre-approval letter and all required documentation with your completed application to be eligible to buy. See "Qualify to Purchase" above for more information.

You may also obtain an application by:

Visiting: 1350 Main Street, Suite 1108, Springfield, MA 01103

Office hours are Monday through Friday from 10am - 2pm or Saturday 9am - 1pm

Email: info@geminispringfield.com

Call/Text: 413-707-2455 (TTY 711)

You may securely upload your completed application by clicking on the below "Application Submission Link"

or

Email to: lotteryinfo@mcohousingservices.com

Fax to: 978-456-8986

Mail to: MCO Housing Services, LLC

P.O. Box 372

Harvard, MA 01451

Overnight mailing address: 206 Ayer Road, Harvard, MA 01451

IMPORTANT: You MUST create an account and THEN submit your completed application with attached mortgage pre-approval letter.

PUBLIC INFORMATION SESSIONS

English Session Option 1:

- Date: May 11, 2024

- Time: 10am - 12pm

-

Location: 1350 Main Street

3rd Floor Conference Room

Springfield, MA 01103

- Passcode: !5JRRNA4

English Session Option 2:

- Date: May 31, 2024

- Time: 6pm - 8pm

-

Location: 1350 Main Street

3rd Floor Conference Room

Springfield, MA 01103

- Passcode: !5JRRNA4

Spanish Session Option 1:

- Date May 11, 2024

- Time: 2pm - 4pm

-

Location: 1350 Main Street

3rd Floor Conference Room

Springfield, MA 01103

- Passcode: i?B=0@eL

Spanish Session Option 2:

- Date: June 7, 2024

- Time: 6pm - 8pm

-

Location: 1350 Main Street

3rd Floor Conference Room

Springfield, MA 01103

- Passcode: ^XX?NA0Q

WATCH OUR PROGRESS

ground breaking

CONDO INFORMATION

REGISTER FOR UPDATES HERE

Contact The Gemini Team at Homes Logic Real Estate

Email: Info@GeminiSpringfield.com

Call/Text: 413-707-2455

Visit: 1350 Main Street, Suite 1108

Springfield, MA 01103

Gemini Developer

Info@HomeCityDevelopment.org

413-785-5312

www.HomeCityDevelopment.org

FAQs

The application provides the eligibility criteria. There are income and asset guidelines to qualify. Generally, you need to be a first-time home buyer and meet the eligibility requirements. There are exceptions to the first-time homebuyer requirements which are listed under the appropriate FAQ below.

This affordable housing community offers both 2- and 3-bedroom units as well as handicap accessible units, catering to a variety of family sizes and needs.

Units are allocated through an application process as first-come, first-serve. This is designed to ensure a fair and equitable opportunity for all eligible applicants to purchase a home.

The household income and asset limits are established based on the area’s median income and are intended to support affordable housing availability for moderate to low-income families. Specific limits are provided by the housing program or authority overseeing the process and can vary by location and household size. The Monitoring Agent will determine eligibility based on financial documents submitted with the application.

Yes, there are certain exceptions to the first -time homebuyer requirement. They are:

- Displaced homemakers, where the displaced homemaker (an adult who has not worked full-time, full year in the labor force for a number of years but has, during such years, worked primarily without remuneration to care for the home and family), while a homemaker, owned a home with his or her partner or resided in a home owned by the partner;

- Single parent, where the individual owned a home with his or her partner or resided in a home owned by the partner and is a single parent (is unmarried or legally separated from a spouse and either has 1 or more children of whom the individual has custody or joint custody, or is pregnant); or

- Any individual who has owned a dwelling unit who structure is not permanently affixed to a permanent foundation in accordance with local or other applicable regulations or is not in compliance with applicable building codes, or other applicable code, and cannot be brought into compliance with the codes for less than the cost of constructing a permanent structure.

Applicants interested in participating in a unit must complete the application process. For this, a mortgage pre-approval is required along with other documentation, if applicable. Your financial documentation, proof of income, assets, tax returns, will be required only if you have the opportunity to purchase post lottery. You can apply by downloading the application found on this page and following the submission instructions.

This process provides you with opportunity to purchase only. You will need to provide all income, asset and tax documentation and a mortgage pre-approval letter along with your application to determine program eligibility. If you are determined eligible then you will move forward with the purchase process.

Yes, however there may be restrictions on the sale price which depends on how long you own the unit. A Deed Rider will be signed at closing which will state the resale process. The application provides a summary of restrictions based on the 80% and 100% AMI designated units. The Deed Rider will be provided with the Purchase and Sale Agreement, if you have the opportunity to purchase.

Refer to the Application which can be found under the How to Apply tab on the above navigation bar.

© 2024 GEMINI SPRINGFIELD TOWNHOMES | ALL RIGHTS RESERVED